Land Tax: Who in Ukraine Can Avoid Paying for the Plot.

Owners of land plots and land shares, as well as land users, are taxpayers of the land tax. Land plots and land shares, which are owned or used, are objects of taxation by the land tax.

Local self-government bodies independently establish rates for land and land tax.

Individuals who are land tax payers have certain benefits. These benefits are established in accordance with the Tax Code of Ukraine.

persons with disabilities of the first and second groups; individuals raising three or more children under 18 years old; pensioners (by age); war veterans and persons to whom Law No. 3551-XII 'On the Status of War Veterans, Guarantees for Their Social Protection' applies; individuals recognized as a result of the Chernobyl disaster.

Exemption from land tax applies to land plots depending on their type of use with established maximum norms.

According to the norms of the single tax of the fourth group, owners of land plots and land shares who rent them out are exempt from tax payment.

Benefits for land tax are provided taking into account the data from the State Land Cadastre. The calculation of land tax is carried out separately for each individual by tax authorities.

Read also

- Every month 24 thousand UAH — who among Ukrainians will receive such payments

- Missing in action property — can relatives inherit

- Pensions for III group of disabilities - how much will be paid in August

- You Are Being Manipulated — What Phrases Indicate This

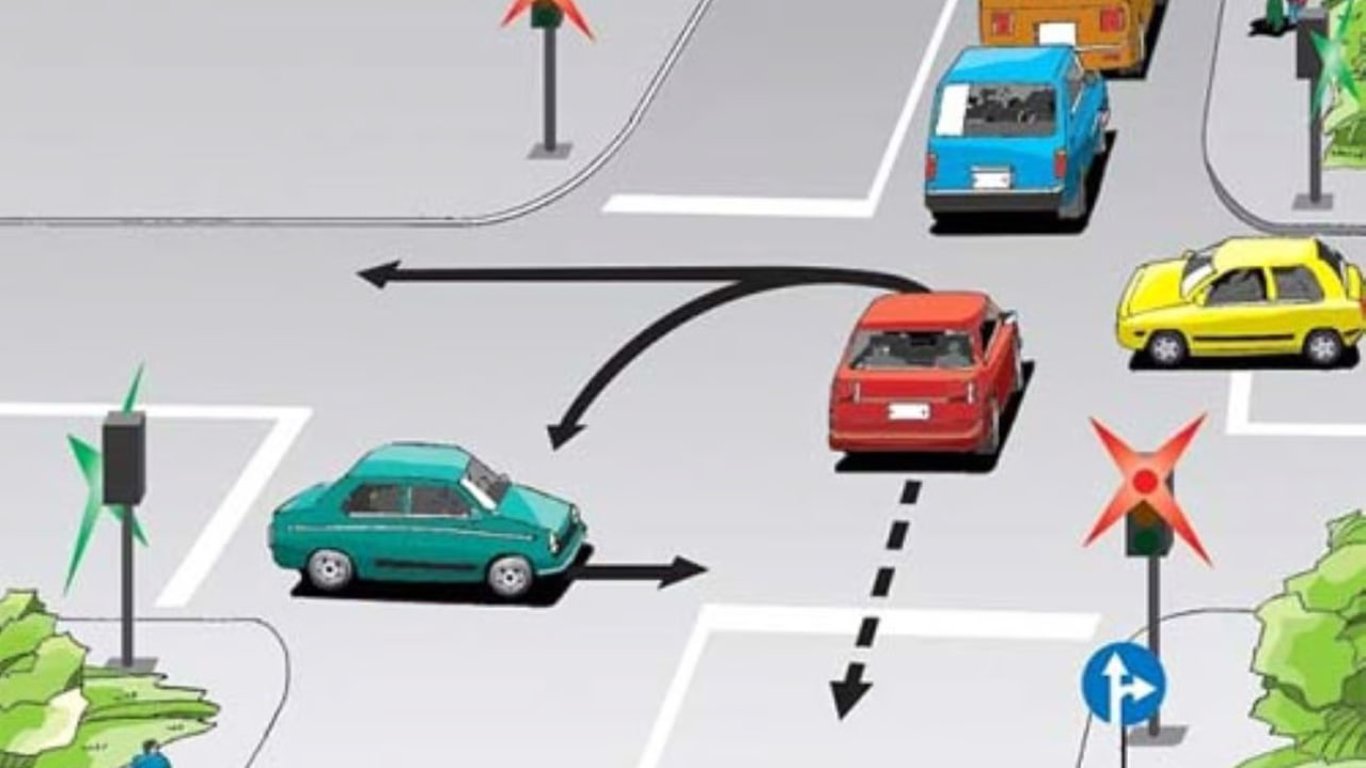

- Interesting traffic rules test — how the driver should navigate through a traffic jam

- Woman demanded money from her father and expelled him from home — court verdict